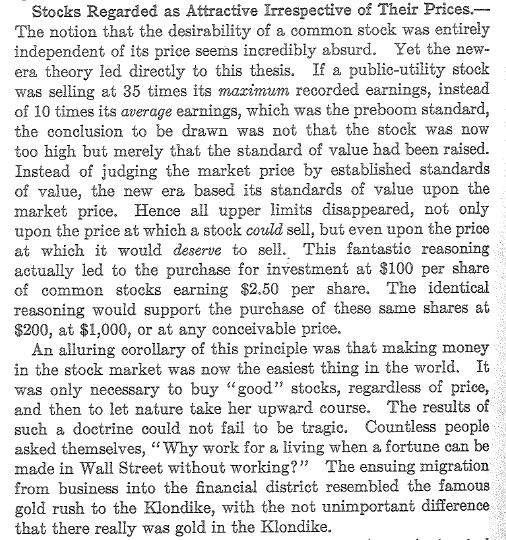

Read the article from above…and then guess what year it was written in.

There are times in stock market history when it’s time to bet smaller. At the risk of equating sophisticated investing to crude gambling, it’s like blackjack, when you you double down when you have an 11, and not when you have a 12. In real investing, you double down when the stock is selling for a lower multiple of earnings than normal. When amateur investors ask me about stocks, rarely do they bring up valuation of the stock. They almost always mention how “the stock is only going up”.

A quick primer on valuation: P/E is a ratio of the Price of the stock divided by the Earnings, meaning, how much are you paying for every dollar of earnings that the company makes in a year. This is also the number of years that you would break even with the company, assuming the earnings do not grow over that time. If you invert the P/E to E/P, that’s the yield of the company. So, a $100M company making $15M in earnings every year is a 6.67 PE. Invert it to E/P, and the company yields 15% every year in earnings. Then you have something by which to compare investments to one another.

Oh, the article was written in 1929….