In full disclosure, I own GM. It’s a company that is producing numbers that are incredible.

Revenues are slightly up, but you can’t expect double digit growth in the car world. Each $34 share earns around $6.20/year in earnings. GM retains 75% of this to reinvest in the business. Return on equity is 20%, and has trended a bit down in the last few years. I suspect it is because they are investing heavily in self-driving technology, which is not producing a return yet.

Book value per share is about $30. At today’s price of $34, you pay $30 for the book value and $4 for the future cash flows.

Like the article mentions, if there is a downturn in the auto market, people will think twice about buying a $80,000 Tesla, but will think once about buying a $20,000 GM.

Articles like this further depress GM stock price, which is a present to us value investors. Keep it low as long as possible, please. We love bargain bin stocks.

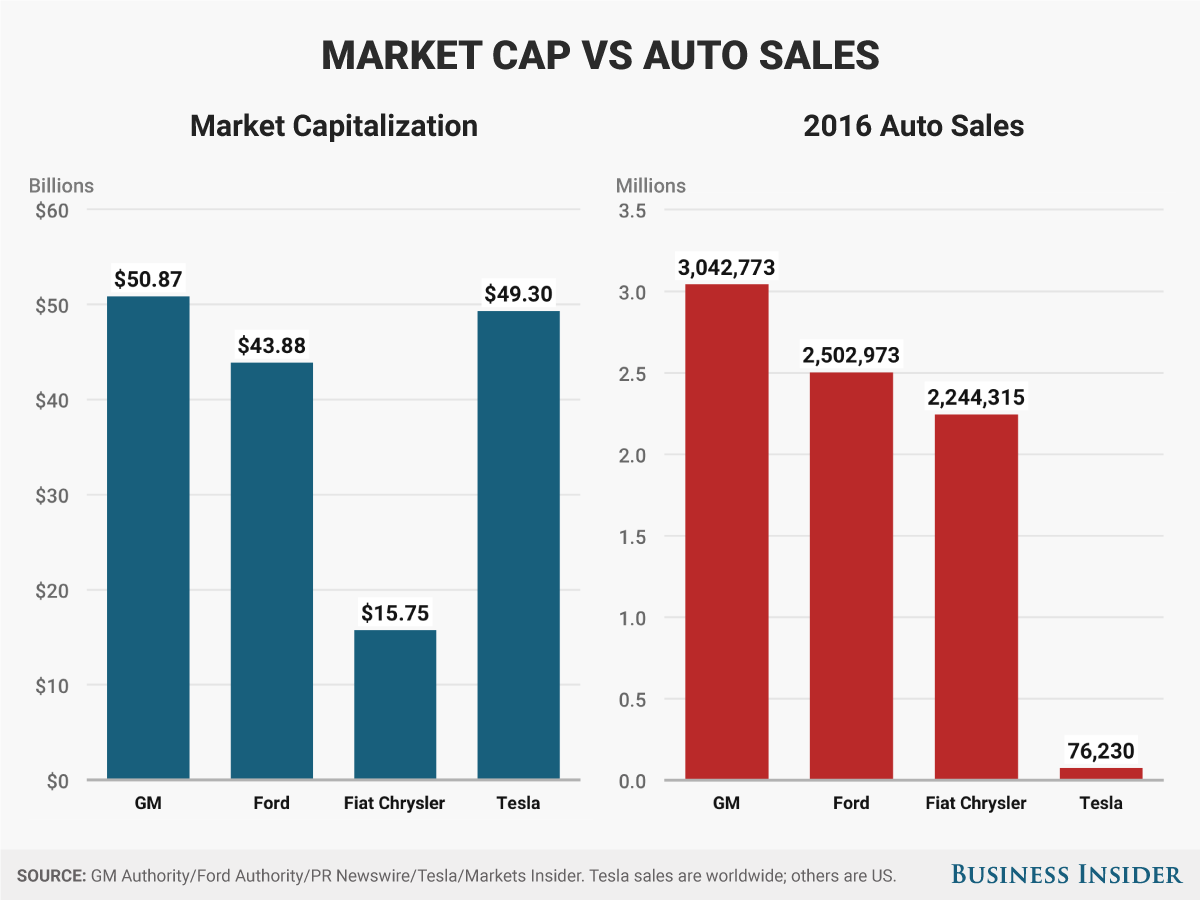

Wall Street has been indifferent to an epic auto-sales recovery where Ford and GM are concerned.

Source: Nightmare scenario starting for Ford and General Motors – Business Insider