This man, studying to be an orthodontist, took out $600k in loans. No doubt, much of this was to pay for living expenses. Whether he lived frugally or extravagantly, he will probably never admit (or not really know the difference), but after he started working and making over $200k, he only paid a fraction of the payment, which never touched the principal loan amount, and did not even cover the interest!

Meaning, he’s paying interest on the interest. The investor’s dream is earning compounding interest, but paying compounding interest is a sure-fire way to permanent financial servitude. Especially with student loans, which are not forgivable.

Why are they not forgivable? Because people like this guy would go to school, and rack up hundreds of thousands of dollars in loans (which typically are sourced from elderly people who invest their money in low, fixed income loan instruments), and after graduating, would declare bankruptcy and never pay back the loan (sorry, grandma, that 28 year old soon-to-be-doctor just ran off with your life savings).

His response in the article says that he just avoided looking at his debt, which compounded the problem! Instead of dealing with the financial cancer, he just ignored it, and it got worse.

Like I did, I had a negative net worth for the first couple of years (including student debt), but we lived in a small apartment and lived frugally, trying to pay off all our debts and setting our school loan interest at a paltry 2.25%. We still have this debt, since inflation basically eats away at the interest (we could have written a check to close the loan, a long time ago, but I chose to invest the money instead.)

This could be your story, whether it’s $1k, $10k, $100k, or $1M, you cannot ignore your debt. It will destroy you, if you don’t take care of it.

Don’t. Be. This. Guy.

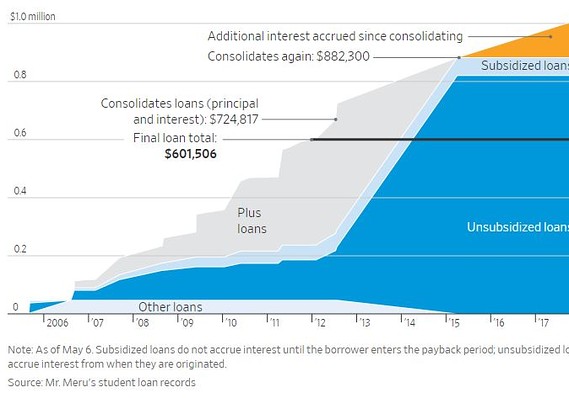

While studying at USC to become an orthodonist — dental school is among the costliest of all graduate curricula — Mike took out $601,506 in student loans. Today that debt has grown to seven figures, and even that could double over time.

Source: He ran up a million dollars in student-loan debt en route to becoming an orthodontist